We’ve told you a lot about technical trading strategies. But we want to remind you that there is another important part of trading: fundamental analysis. And, if there is fundamental analysis, there should be fundamental trading strategies too.

Let’s start with the most common and simplest strategies: the carry trade strategy.

This strategy is based on interest rates. In our FBS Academy course, we told you that interest rates are a perfect indicator of economic conditions in every economy of the world. It’s a fast and clear way to estimate which economy is stronger and as a result, what currency will strengthen. A country with a weak economy has a low interest rate. It’s a way for a central bank to encourage credit growth and give business cheap money to pour into the economy. The currency of such a country is weak. A strong economy has strong GDP growth and rising inflation. To limit inflation, a central bank has to raise interest rates, making the domestic currency go up.

The difference in interest rates gives long-term investors an opportunity to earn.

So what is the idea of the carry trading strategy

The main idea of the strategy is “buy a currency with a high interest rate and sell a currency with a low one”.

A trader borrows a cheap currency (with a low interest rate), for example, the Japanese yen. They invest it in profitable assets, like the Australian dollar. The yen will be the funding currency, and the Australian dollar is the investment currency. As a result, capital flows from Japan to Australia increase and demand for the Australian dollar rises. Remember that flows increase when there is a risk-on sentiment, so traders want to invest in more profitable but risky currencies. In the end, AUDJPY surges.

Another thing worth mentioning is a swap. A swap is the procedure of moving open positions from one trading day to another. If a trader extends their position beyond one day, they will be dealing with a cost or gain, depending on prevailing interest rates.

For example, imagine that the Australian dollar had a higher interest rate than the Japanese yen. If you were to buy AUDJPY, you would earn the interest difference between the AUD and the JPY or so-called swap on your position every day you held that trade overnight. However, if you sold AUDJPY, you would pay the swap for your position every day you held that trade overnight.

Trade nowHow to determine the right pair to get a profit

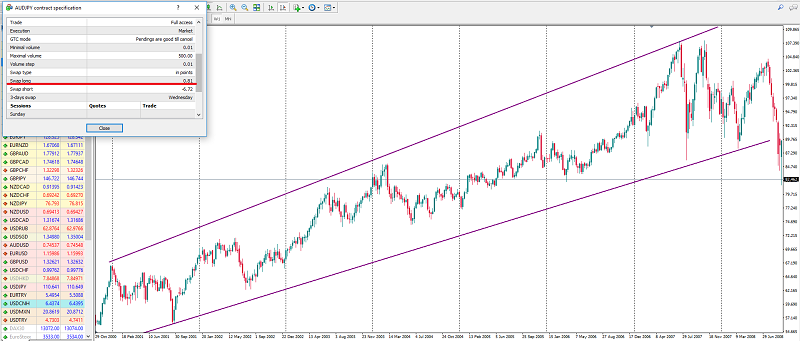

It’s easy to determine a pair that will give you a good chance to earn money. Open your MetaTrader. On the left part of the screen, there is a Market Watch window.

In it, click on the pair you want to check. As we used AUDJPY in the example, we will click on this pair. In the pop-up window, you will see a Specification line.

Click on it and you will see a new window. There, you should find Swap long. As you can see from our example, AUDJPY has a small positive swap for long positions (0.81). That’s a good sign.

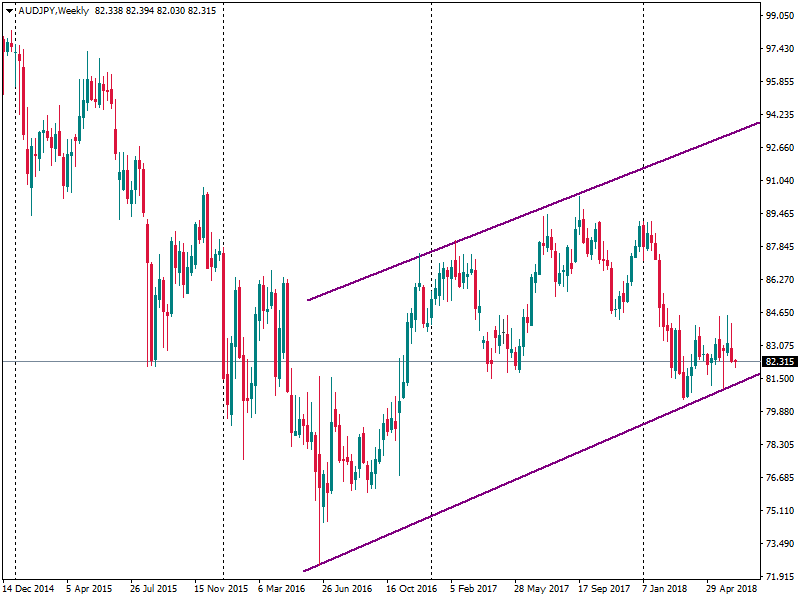

Next, check a weekly chart of the pair you want to trade. A long uptrend signals a good possibility to trade the pair.

Let’s study an example. On the weekly chart of AUDJPY, we see an uptrend from the beginning of 2000 to the beginning of 2008 (when the financial crisis happened). The fact that a trend lasted for 8 years showed that the pair is safe enough to use the carry trade strategy.

Let’s have a look at the present moment. You should remember that any long uptrend isn’t constant. After it ends, it’s important to wait until the next one is formed. Since January 2016 a new uptrend started forming. It’s a good sign to invest in the pair.

As you can see, it’s very simple to find a pair that will give you profit over the long period. That’s why the carry trade strategy is an easy way to earn money.

However, you should keep some of its features in mind.

Three of the strategy’s features you should remember:

This strategy corresponds only to long-term trading. You should know how to work on big timeframes. It’s important to know how to distinguish a correction of the pair that can last for several days from a global trend reversal. You should be calm and confident in your strategy. Open a position for several months, and you will earn.

Remember that the carry trading strategy is a low-risk strategy. That means your profit isn’t anticipated to be very high. A general rule to be aware of is: higher risk – higher profit, lower risk – lower profit. If you want to use this strategy and have greater profits, you need to start with a bigger deposit.

Don’t forget about fundamental analysis. If you opened an order based on this strategy, that doesn’t mean you can leave the trading without your attention. You should check interest rates constantly as they may change at any time. Even market expectations of a rate hike or decline affect a currency rate. Moreover, there are other factors that can affect a pair’s direction. As we could see in our example, after an 8-year uptrend the pair plunged because of the 2008 financial crisis. In the environment of instability, traders started investing in the Japanese yen, which is a safe-haven.

In conclusion, the carry trading strategy is a simple strategy that doesn’t require special financial knowledge. All you need is to know the interest rate difference of currencies you want to trade. However, you should remember the features of carry trading. If you have enough patience to wait for months to get a good profit, you should definitely use it!